{{currentView.title}}

June 29, 2021

The economic cost of terrorism in Africa

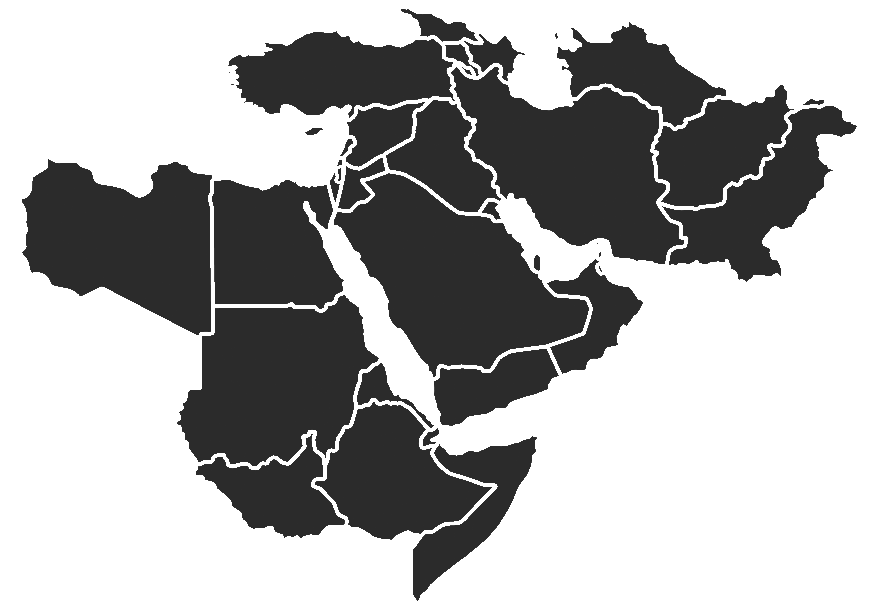

Terrorists are costing Africa billions of dollars. This sum will only rise now that the Islamic State’s newest African affiliate has derailed the continent’s largest private investment. French oil titan Total declared force majeure on a $20 billion liquid natural gas project in northern Mozambique in April in response to a burgeoning Islamic State-linked insurgency. Total’s withdrawal adds to the already rising cost of terrorism in Africa, which ballooned from $1.54 billion in 2007 to $15.5 billion in 2016. Money that should be fueling economic growth and better governance for millions is instead being lost to destructive insurgencies and pocketed by terrorists with global aims.

Mozambique’s misfortune is far from the only case of jihadist-induced economic devastation in Africa. Tunisia’s tourism revenues shrank by 35 percent following terror attacks in 2015, undermining a major economic sector for two years. Insurgents’ activities also prevent states from accessing their natural resources, like when Nigerian extremist group Boko Haram blocked oil exploration in the country’s northeast in 2017. And even when companies remain active, their operational costs rise — for example, a Canadian mining company in Burkina Faso began transporting employees by helicopter due to Islamic State-linked attacks in 2018.

The economic damage extends to local food production. Boko Haram’s money-making activities include stealing livestock and infiltrating the fishing industry in northeastern Nigeria. Authorities have responded by restricting fishing, closing markets, and limiting fertilizer use to deny militants’ access to bombmaking materials. These security measures undermined civilian agricultural production, cutting off farmers from 80 percent of potential agricultural land in the area. Salafi-jihadi violence also deters investors. A 2019 UN study found that a group of 18 African countries affected by terrorism suffered a 43 percent drop in foreign direct investment from 2007 to 2016.

Some lost income goes to Salafi-jihadis themselves, through illegal businesses and extortion rackets. Al Qaeda’s affiliates in north and west Africa have raked in more than 100 million dollars in 10 years from kidnappings and trans-Saharan smuggling. Salafi-jihadis’ criminal activity not only funds their attacks but also crowds out licit markets and encourages organized crime. The instability created by Salafi-jihadis in northern Nigeria has fueled a rash of kidnappings of schoolchildren for ransom, for example. Salafi-jihadis also extort the populations they control. Al Shabaab in Somalia brings in millions in annual “tax revenues” from its checkpoints and businesses — a windfall that nearly equals Somalia’s official tax revenues.

The costs go beyond areas Salafi-jihadis can reach. The economic impact of refugees and internally displaced people (IDPs) on the 18 terrorism-affected countries in the same UN study was $312.7 billion over 10 years, not including the impact on destination countries and international donors. Salafi-jihadi groups in Burkina Faso and Mozambique are responsible for some of the fastest-growing displacement crises in Africa. A record 29 million people in West Africa require humanitarian aid in 2021. But donations are far below target for refugees and IDPs across Africa, reflecting an overextended international humanitarian system and the pandemic’s effects on donor countries.

The shutdown of Total’s project in northern Mozambique is part of a larger story that deserves more attention. Natural gas was meant to underwrite decades of Mozambique’s economic growth. Africa’s rapidly expanding population and its untapped potential and resources should make the continent increasingly important in the global economic landscape. Discussions of Africa’s economic prospects often neglect the violence plaguing the continent, however. Many African countries — including Mozambique and the East African giant, Ethiopia — are wavering between a future of peace and prosperity, and one of fragmentation and festering conflict.

The many costs of Salafi-jihadi insurgencies are not only an African problem. Terrorist attacks and refugee flows remain major concerns for European countries. Global interests ranging from public health to freedom of navigation require sufficient security. Africa’s prosperity — a popular bipartisan cause — cannot be maximized while spreading Salafi-jihadi insurgencies sap resources and trap millions of people in cycles of violence and displacement. US policymakers and their African counterparts must overcome the political and policy hurdles to ending these insurgencies. The US approach should include long-term diplomatic engagement, targeted aid, and a strategy for rolling back insurgencies and eliminating opportunities for Salafi-jihadis. The physical and economic security of millions of Africans hangs in the balance.